Comprehensive Guide to Google Pay APK: Features, Benefits, and Usage

Google Pay APK has become a cornerstone in the realm of digital payments, offering a seamless, secure, and versatile platform for users worldwide. Designed to simplify transactions, Google Pay integrates a range of features tailored to meet diverse financial needs, from in-store purchases to online bill payments. This article delves into the core functionalities, security measures, and unique offerings of Google Pay, with a special focus on its relevance in markets like India, where it has transformed the digital payment landscape.

What is Google Pay APK?

Google Pay is a mobile payment application developed by Google, enabling users to make contactless payments, send and receive money, pay bills, and access a host of financial services directly from their smartphones. Available on Android and iOS platforms, Google Pay leverages advanced technologies like UPI (Unified Payments Interface) in India and NFC (Near Field Communication) globally to facilitate quick and secure transactions. The Google Pay APK refers to the Android application package, which powers the app on Android devices, delivering a user-friendly interface and robust functionality.

The app’s versatility lies in its ability to cater to both personal and business transactions. Whether you're paying at a local store, splitting a bill with friends, or managing recurring utility payments, Google Pay simplifies the process with minimal effort.

Core Features of Google Pay APK

Google Pay offers an extensive suite of features, making it a go-to solution for millions of users. Below, we explore the primary functionalities that define its appeal.

Advertisement

Seamless Payments at Stores and Online

Google Pay enables users to make payments at their favorite physical and online stores with ease. For in-store purchases, the app uses NFC technology, allowing users to tap their phones on compatible payment terminals. Online, Google Pay integrates with numerous merchants, enabling quick checkouts on platforms like Myntra, Zomato, and MakeMyTrip. Users can link their debit or credit cards to the app for faster transactions, with support for Visa cards from major banks like Axis, HDFC, ICICI, SBI, and SCB.

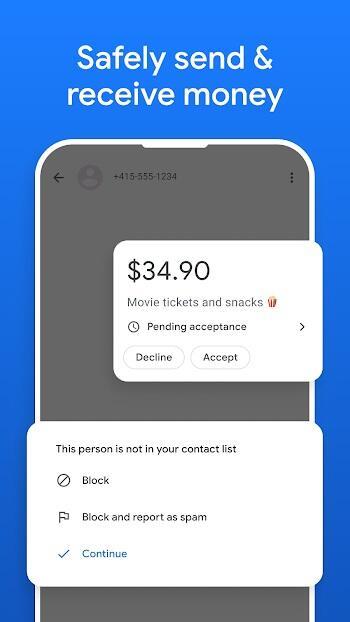

Instant Money Transfers

One of Google Pay’s standout features is its ability to send and receive money instantly. In India, the app supports UPI, allowing direct bank-to-bank transfers without the need for wallet top-ups or additional KYC verification. Users can transfer funds to anyone, even those not using Google Pay, as long as they have a valid bank account. This feature eliminates the hassle of cash or traditional banking methods, making peer-to-peer payments effortless.

Bill Payments Made Simple

Google Pay simplifies the process of paying utility bills, including electricity, water, gas, broadband, and landline services. By linking accounts once, users receive timely reminders to settle their bills with just a few taps. The app collaborates with service providers across India, ensuring broad coverage and convenience. Additionally, Google Pay supports mobile recharges and DTH (Direct-to-Home) top-ups, offering access to the latest prepaid plans and recurring recharge options.

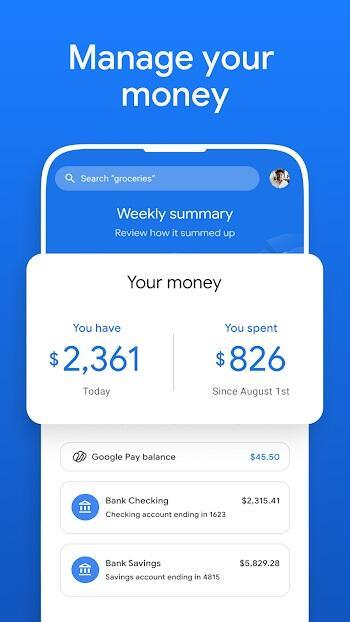

Check Bank Balance Anytime

For users in India, Google Pay provides a convenient way to check bank account balances without visiting an ATM or logging into online banking portals. This feature is particularly useful for those who need quick access to their financial status on the go, enhancing the app’s utility as an all-in-one financial tool.

Rewards and Cashback Incentives

Google Pay incentivizes usage through its rewards program. Users can earn cashback, discounts, and exclusive offers by making payments, referring friends, or participating in promotional campaigns. These rewards are credited directly to the user’s bank account, adding tangible value to everyday transactions. The referral program, in particular, encourages users to invite others to join the platform, fostering a growing community of digital payment adopters.

QR Code Payments

For offline transactions, Google Pay supports QR code-based payments, a popular method in markets like India. Users can scan QR codes at stores, restaurants, or small businesses to complete payments instantly. This feature is particularly beneficial for micro-transactions, enabling even street vendors to accept digital payments effortlessly.

Travel and Lifestyle Bookings

Google Pay extends beyond payments, offering integration with travel and lifestyle services. Users can book flights, bus tickets, and train tickets (including IRCTC bookings with Tatkal support) directly through the app. Partnerships with platforms like redBus, Goibibo, and MakeMyTrip ensure a seamless booking experience. Additionally, food ordering through Zomato is supported, making Google Pay a versatile hub for daily needs.

Buy, Sell, and Gift Gold

A unique offering in India, Google Pay allows users to buy, sell, and gift 24K gold through a partnership with MMTC-PAMP. Gold purchased via the app is stored securely in a digital Gold Locker or delivered as physical coins. Users can also gift gold to friends or earn gold as part of Google Pay’s rewards program. This feature taps into the cultural significance of gold in India, providing a modern twist to traditional investments.

Security: A Top Priority for Google Pay APK

Security is at the heart of Google Pay’s design, ensuring users can transact with confidence. The app employs multiple layers of protection, combining Google’s world-class security infrastructure with banking-grade safeguards.

UPI PIN and Device Lock

Every transaction on Google Pay requires authentication, typically through a UPI PIN or device-based methods like fingerprint or face recognition. This ensures that only authorized users can access and use the app, even if the device is lost or stolen.

Bank-Level Encryption

Funds remain in the user’s bank account until a transaction is initiated, minimizing exposure to risks. Google Pay does not store money in a separate wallet, reducing the likelihood of unauthorized access. All payment data is encrypted, and the app works closely with banks to protect sensitive information during online and offline transactions.

Advertisement

Fraud Detection and Monitoring

Google Pay’s advanced algorithms actively monitor for suspicious activity, detecting potential fraud attempts in real-time. This proactive approach helps safeguard users’ finances, providing peace of mind whether they’re shopping at a store or transferring money to a friend.

Collaboration with Banks

Google Pay integrates with banks that support BHIM UPI in India, ensuring compliance with local regulations and standards. This collaboration extends to card-based payments, where supported banks issue tokenized cards for secure transactions, reducing the risk of data breaches.

Why Google Pay Stands Out in India

India’s digital payment ecosystem has seen rapid growth, and Google Pay has emerged as a leader in this space. Its integration with UPI, a government-backed payment system, has made it a preferred choice for millions of users. Here’s why Google Pay resonates so strongly in the Indian market:

Support for BHIM UPI

Google Pay’s compatibility with BHIM UPI allows it to work with virtually all banks in India. This universal access eliminates barriers, enabling users to link multiple bank accounts and switch between them seamlessly.

Localized Features

From bill payments to mobile recharges and gold investments, Google Pay caters to India-specific needs. The app’s support for regional languages and partnerships with local merchants further enhances its accessibility and appeal.

Empowering Small Businesses

By enabling QR code payments, Google Pay empowers small businesses, street vendors, and unorganized retail to accept digital payments. This inclusivity aligns with India’s push toward a cashless economy, bridging the gap between traditional and modern commerce.

Instant Refunds and Tatkal Support

For train travelers, Google Pay’s integration with IRCTC simplifies ticket bookings, including Tatkal reservations. The app also processes refunds instantly, ensuring a hassle-free experience for users.

How Google Pay Enhances User Experience

Google Pay’s intuitive design and comprehensive features create a frictionless user experience. The app’s clean interface makes navigation effortless, while its integration with Google services adds convenience. For example, users can access transaction history, manage linked accounts, and explore offers within a single platform.

The app also supports multiple payment methods, including UPI, debit/credit cards, and bank accounts, giving users flexibility. Whether you’re a tech-savvy millennial or a first-time smartphone user, Google Pay’s simplicity ensures broad adoption.

Limitations and Considerations

While Google Pay is a robust platform, there are a few considerations to keep in mind:

- Card Support: Credit and debit card payments are still expanding, with limited bank partnerships for now. Users should verify if their bank supports Google Pay’s card-based transactions.

- Internet Dependency: Most features require an active internet connection, which may be a challenge in areas with poor connectivity.

- Regional Availability: Some features, like gold investments and IRCTC bookings, are exclusive to India, limiting their global applicability.

Despite these constraints, Google Pay continues to evolve, with regular updates introducing new features and broader compatibility.

Future Prospects of Google Pay APK

As digital payments gain traction globally, Google Pay is poised for further growth. The app’s focus on security, convenience, and innovation positions it as a leader in the fintech space. In India, the expansion of UPI and increasing smartphone penetration will likely drive adoption, while global markets may see enhanced NFC and card-based integrations.

Google Pay’s rewards program and partnerships with merchants suggest a future where the app becomes a holistic financial ecosystem, encompassing payments, investments, and lifestyle services. With Google’s backing, the platform is well-equipped to adapt to emerging trends and user needs.

Conclusion

Google Pay APK is more than just a payment app—it’s a comprehensive financial tool that simplifies transactions, enhances security, and adds value through rewards and integrations. From paying bills to booking travel and investing in gold, Google Pay caters to a wide range of needs, particularly in India’s dynamic digital economy. Its robust security measures, user-friendly design, and innovative features make it a trusted choice for millions.

Whether you’re making a quick QR code payment at a local shop or managing your finances on the go, Google Pay delivers a seamless experience. As the app continues to evolve, it remains a powerful ally for anyone navigating the world of digital payments.

Let's build community together and explore the coolest world of APK Games/Apps.

1. This is the safest site on the Internet to download APK. 2. Don't ask about the Play Protect warning, we've explained it well, check here. 3. Do not spam, be polite and careful with your words.